Reports &Presentations

Q3 2021

Q3 2021

Q3 2021

Q2 2021

Q2 2021

Q2 2021

Q1 2021

Q1 2021

Q1 2021

2018

2018

Q3 2018

Q3 2018

Q2 2018

Q2 2018

Q1 2018

Q1 2018

2017

2017

Q3 2017

Q3 2017

Q2 2017

Q2 2017

Q1 2017

Q1 2017

2016

2016

Q3 2016

Q3 2016

Q2 2016

Q2 2016

Q1 2016

Q1 2016

2015

2015

Q3 2015

Q3 2015

Q2 2015

Q2 2015

Q1 2015

Q1 2015

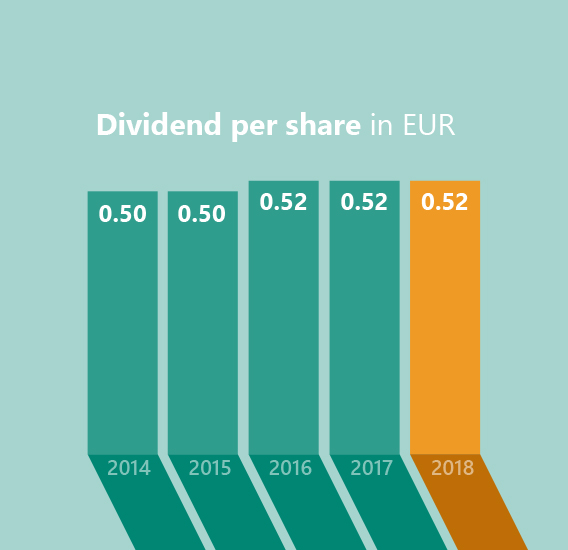

DIVIDEND

We generate sustainable surpluses based on our proactive building management, first-class tenant structure and high balance sheet quality. Our shareholders benefit from this. Since the company was founded, alstria has distributed very attractive dividends to its shareholders every year.

ANALYST COVERAGE

alstria is currently being observed by 18 analysts who publish their reviews on a regular basis.

Rating

On November 04, 2015, Standard & Poor´s Rating Services published a Long-term Issuer Rating for alstria office REIT-AG for the first time.

Rating result: BBB (Outlook: positive)

Ratings Direct Update

as of September 20, 2018

Ratings Direct Analysis

as of October 02, 2017

Ratings Direct Update

as of September 28, 2016

Bonds

The terms and conditions of the bonds set out below do not constitute a prospectus nor do they constitute or form part of an offer to sell or purchase, or the solicitation of an offer to sell or purchase, securities. The bonds have not been and will not be registered under the United States Securities Act of 1933, as amended (the “Securities Act”). These bonds may not be offered, sold or otherwise transferred, directly or indirectly, to United States Persons or in any jurisdiction in which offers or sales of the securities would be prohibited by applicable law (including in or into the United States of America, Italy, Canada and Japan) absent registration or an exemption from registration under the Securities Act or respective securities laws.

Issuer: |

alstria office REIT-AG |

|---|---|

Issue date: |

November 15, 2017 |

ISIN: |

XS1717584913 |

WKN: |

A3GSE1 |

Listing: |

Regulated market of the Luxembourg stock exchange |

Aggregate principal amount: |

EUR 350,000,000 |

Denomination: |

EUR 100,000 |

Interest rate: |

1.5% (payable annually in arrear) |

First interest payment: |

November 15, 2018 |

Maturity date: |

November 15, 2027 |

Rating of the note: |

BBB (S&P) |

November 14, 2017

November 08, 2017

November 08, 2017

Emittent: |

alstria office REIT-AG |

|---|---|

Begebungsdatum: |

15. November 2017 |

ISIN: |

XS1717584913 |

WKN: |

A3GSE1 |

Börsennotierung: |

Geregelter Markt der Luxemburger Wertpapierbörse |

Gesamtnennbetrag: |

EUR 350.000.000 |

Stückelung: |

EUR 100.000 |

Verzinsung: |

1,5% (jährlich im Nachhinein zahlbar) |

Erste Zinszahlung: |

15. November 2018 |

Fälligkeit: |

15. November 2027 |

Rating der Anleihe: |

BBB (S&P) |

14. November 2017

08. November 2017

08. November 2017

Issuer: |

alstria office REIT-AG |

|---|---|

Issue date: |

April 12, 2016 |

ISIN: |

XS1346695437 |

WKN: |

A169L5 |

Listing: |

Regulated market of the Luxembourg stock exchange |

Aggregate principal amount: |

EUR 325,000,000 |

Initial amount: |

EUR 500,000,000 |

Denomination: |

EUR 100,000 |

Interest rate: |

2.125% (payable annually in arrear) |

First interest payment: |

April 12, 2017 |

Maturity date: |

April 12, 2023 |

Rating of the note: |

BBB (S&P) |

2016

November 16, 2017

April 05, 2017

November 17, 2015

2015

2014

February 26, 2016

Issuer: |

alstria office REIT-AG |

|---|---|

Issue date: |

November 24, 2015 |

ISIN: |

XS1323052180 |

WKN: |

A1685N |

Listing: |

Regulated market of the Luxembourg stock exchange |

Aggregate principal amount: |

EUR 326,800,000 |

Initial amount: |

EUR 500,000,000 |

Denomination: |

EUR 100,000 |

Interest rate: |

2.25% (payment payable annually in arrear) |

First interest payment: |

March 2016 |

Maturity date: |

March 24, 2021 |

Rating of the note: |

BBB (S&P) |

2015

November 23, 2015

November 16, 2017

November 17, 2015

November 17, 2015

Q3 2015

2014

2013

Q3 2015

Annual General Meeting

The annual general meeting of the alstria office REIT-AG took place on 22nd of May 2019 .

2017

2016

2015

2014

2013

2012

2011

2010

04. June 2009

2009

financial calendar